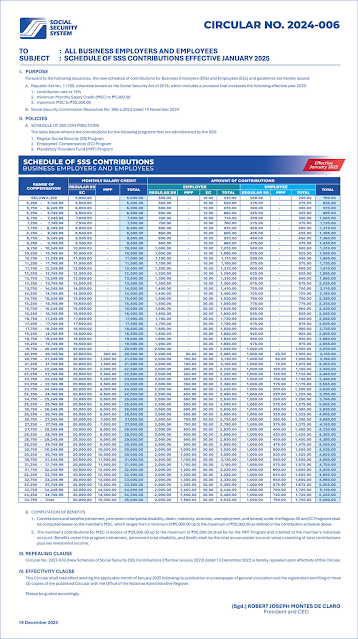

New SSS schedule contribution effective January 2025

📊 Key Updates

-

Total Contribution Rate: Increased from 14% → 15% of Monthly Salary Credit (MSC)

-

Employer’s Share: Rises to 10% (formerly 9.5%)

-

Employee’s Share: Goes to 5% (formerly 4.5%)

-

Self‑employed / Voluntary / OFWs: Pay the full 15%

💰 Updated MSC Range

-

Minimum MSC: ₱5,000/month (up from ₱4,000)

-

Maximum MSC: ₱35,000/month (up from ₱30,000)

🛠 Breakdown of Contributions

-

For Employed Members:

Party Contribution Employer 10% of MSC (plus EC premium: ₱10 or ₱30) Employee 5% of MSC -

For Self-employed / Voluntary / OFWs:

-

Entire 15% of MSC, plus the EC contribution

-

📈 Why the Changes?

-

Mandated by RA 11199 (Social Security Act of 2018) — the final scheduled increase to secure SSS’s long-term sustainability

-

Expected to extend the fund’s lifespan well into the 2050s

TABLE OF CONTRIBUTIONS

📌 Disclaimer

The information provided in this article is for general informational purposes only and is based on publicly available sources as of the latest update. While efforts have been made to ensure accuracy, contribution rates, salary brackets, and government policies may change without prior notice.

This post does not constitute official advice from the Social Security System (SSS) or any affiliated government agency. For updated contribution tables, official computations, and personalized concerns, please visit the official SSS website at www.sss.gov.ph or contact your nearest SSS branch.

The author and this platform are not liable for any loss or damage resulting from reliance on the information presented.

![DILG MC No. 2025-034 | Filling-out of ELOPDS Excel Form for New Elective Officials 2025-2028 [Downloadable Form]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEitsa6tW-w0wEttLG6Zkt_wAfpciK7UvY9Ttz8Xp3HSl6S1Qe8EwGl7B6-3VhnPx1PPZDgynhoyPYzZIcFTEXMo_ndahxCppCv4pxwafstp4lsU0KWyJeDiLEI1CF7a2PzlY9mHnPEokpjDy1x_P-69O54W1VbIEQrUy5qftY2BOlP9_RxmbsTbMXT3TLqD/s72-w640-c-h368/elopds.jpg)

No comments:

Post a Comment